BXP (BXP)·Q4 2025 Earnings Summary

BXP Posts Revenue Beat, Raises 2026 Outlook as Office Leasing Momentum Builds

January 28, 2026 · by Fintool AI Agent

BXP, Inc. (NYSE: BXP), the largest publicly traded owner of premier workplaces in the U.S., delivered Q4 2025 results that beat revenue estimates while demonstrating continued leasing momentum across its gateway market portfolio. The stock rose 1.1% to $65.93 following the call as management raised 2026 guidance and highlighted strong AI-driven demand in San Francisco.

Did BXP Beat Earnings?

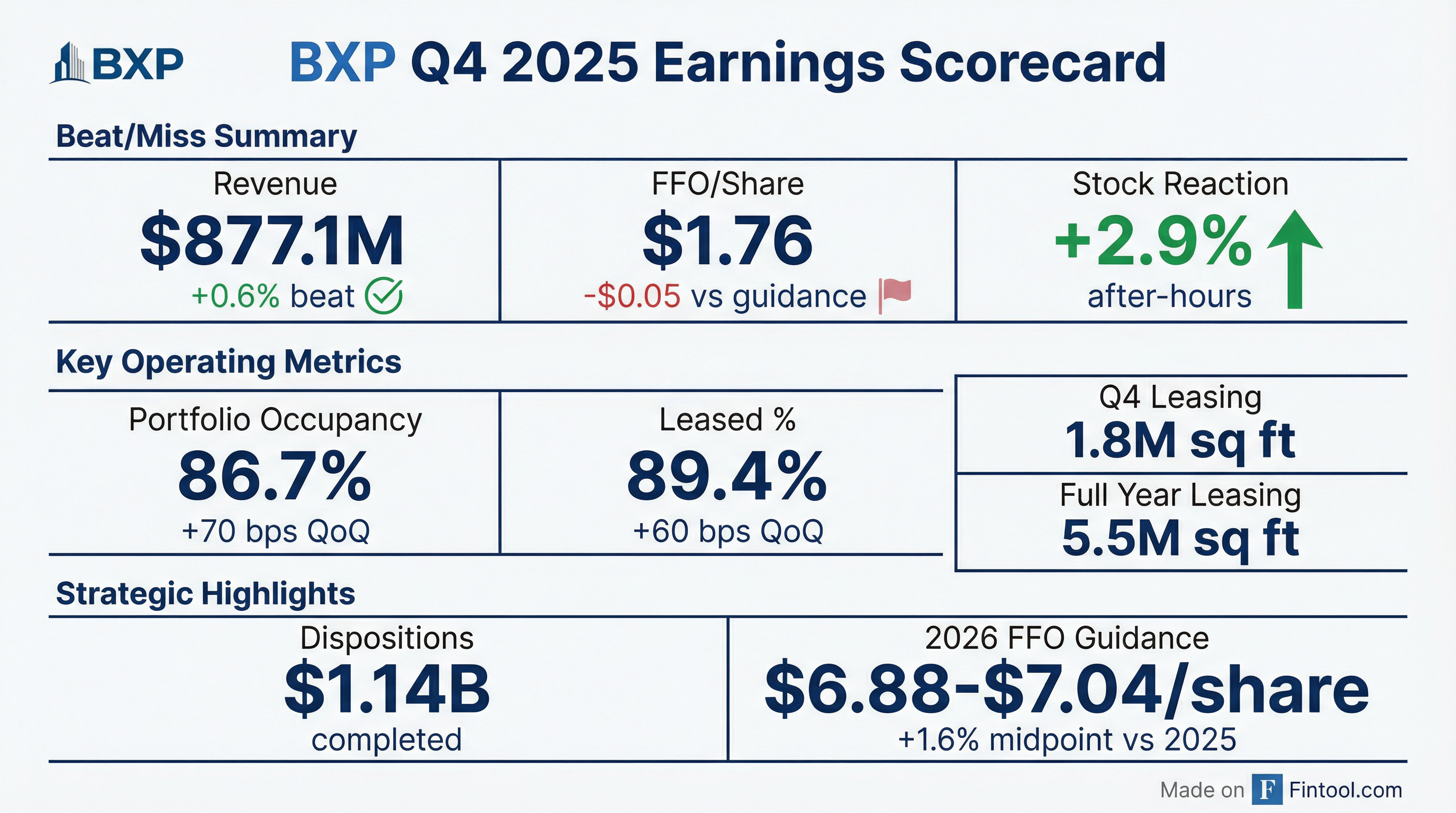

Revenue: Beat by 0.6% — Q4 revenue of $877.1 million topped the $872.0 million consensus estimate. Full-year 2025 revenue totaled $3.5 billion with FFO of $1.2 billion, or $6.85 per share.

FFO: Slight Miss vs Guidance — FFO of $1.76 per share came in $0.05 below the guidance midpoint, driven by two factors:

- Higher G&A: $3.5 million (~$0.02/share) from elevated legal expenses tied to strong leasing activity

- Credit Reserves: $6 million (~$0.03/share) for two client accrued rent balances — a 60,000 sq ft educational services firm in Washington, D.C. and a 10,000 sq ft restaurant in New York City

EPS: Massive Beat (With Caveats) — GAAP EPS of $1.56 exceeded guidance by $0.74, driven entirely by $208 million in gains from $890 million of asset sales.

What Did Management Guide?

BXP raised its 2026 outlook, signaling confidence in the office recovery despite ongoing market headwinds.

2026 Full-Year Guidance:

- FFO: $6.88-$7.04 per share (midpoint $6.96, +1.6% vs 2025's $6.85)

- EPS: $2.08-$2.29 per share

- Same-Property NOI Growth: +1.25% to +2.25%

- Average Occupancy: 87.5% to 88.5%

- AFFO: $4.40-$4.60 per share

Q1 2026 Guidance: FFO $1.56-$1.58 per share (seasonally lowest due to G&A vesting)

FFO Bridge — 2025 to 2026 (Midpoint):

CFO Mike LaBelle noted: "2026 represents a return to FFO growth for BXP. We expect our quarterly FFO run rate to consistently improve through 2026, leading us to a strong base for 2027."

What Changed From Last Quarter?

Leasing Acceleration: Q4 leasing volume of 1.8 million square feet was the strongest quarter of the year. Full-year 2025 leasing totaled 5.5 million square feet, well above goals.

Occupancy Inflection: Portfolio occupancy jumped 70 bps to 86.7%, with ~35% from improved leasing and ~35% from portfolio reduction through asset sales. Management expects to reach 89% by year-end 2026.

Leasing Pipeline Strength:

- 1.2 million sq ft in active lease negotiations (up from 1.1M at quarter-end)

- 1.3 million sq ft in discussions pipeline (~10% larger than Q3)

- 95% conversion rate expected on deals in negotiation

President Doug Linde stated: "The bottom line is that if we were to do no additional leasing in 2026, our occupancy would remain flat for the year... We expect to complete 4 million sq ft of leasing in 2026."

Q&A Highlights

Is AI Cannibalizing Office Demand?

Management pushed back strongly on concerns that AI would reduce office space needs. CEO Owen Thomas noted:

"AI so far for BXP's footprint has been a net plus, not a negative, because we've had very significant AI leasing... Our instinct is that AI is much more likely to dislocate more repetitive tasks and support jobs. Those positions generally are not resident in premier workplaces."

San Francisco AI Demand: Rod Richey, Senior VP for the West Coast, reported that 36% of the 8 million sq ft of tenant demand in San Francisco is from AI or AI-related technology companies:

"Every time we turn around, there's another deal that's being talked about or getting signed... There's the big ones, the OpenAI, the Anthropics of the world, and then there's a lot of small ones too."

NYC AI Expansion: Hilary Spann, EVP for New York, noted that Anthropic is seeking 250,000-450,000 sq ft in New York City.

What's the Mark-to-Market on the Portfolio?

Doug Linde provided granular detail on portfolio mark-to-market:

"The mark-to-market on occupied space across the entire portfolio... is somewhere in the high 4s to low 5% range. That's a meaningful jump from a year ago... Where we've seen the biggest improvements have been in the Back Bay of Boston, our Manhattan portfolio, and at the tops of our buildings on the West Coast."

Regional variations in Q4 cash mark-to-market:

- Boston: +10% (led by Back Bay)

- New York & DC: Flat (space-sensitive)

- West Coast: -10% (still elevated concessions)

Are TI Packages Coming Down?

Doug Linde walked through TI trends by market:

What About Job Layoff Announcements?

Management acknowledged the headlines but noted they aren't seeing weakness in leasing:

"When we see announcements for job losses, it obviously can't be a positive per se for us, but... we're just not seeing weakness in our leasing activity from our clients."

Doug Linde specifically addressed shipping company layoffs: "My assumption is none of those jobs are being lost in any office space in Manhattan, Boston, Washington, D.C., or on the West Coast of California."

Key Property Updates

360 Park Avenue South (NYC)

The 450,000 sq ft Midtown South development has accelerated dramatically:

- January 2025: 100,000 sq ft leased

- Q4 2025: Executed leases on 4 floors, bringing total to 262,000 sq ft (59%)

- Current: Negotiating leases on 6 additional floors to bring building to ~90%

680 Folsom/50 Hawthorne (San Francisco)

Massive turnaround in 60 days:

- October 2025: 208,000 sq ft vacancy, 63,000 sq ft June 2026 expirations, zero leases in negotiation

- Today: Executed 69,000 sq ft, negotiating 132,000 sq ft additional

200 Fifth Avenue (NYC)

Absorbed 350,000 sq ft of vacancy from 2025 with 32,000 sq ft leased in January, leaving only 33,000 sq ft available.

290 Binney Street (Cambridge)

The 573,000 sq ft life science project 100% leased to AstraZeneca:

- Cash rent starts: April 2026

- Revenue recognition: Late June 2026 (C of O timing)

- Interest capitalization: Stops June 30

Development Pipeline

343 Madison Avenue (NYC): The flagship 930,000 SF tower is progressing with:

- Pre-leased: 29% to Starr Insurance (mid-tower)

- In negotiation: 16% for space above Starr

- Target: 30-50% leveraged equity partner and ~$1 billion construction financing in 2026

- Delivery: 2029

2100 M Street (Washington DC): New pre-leased development announced:

- Client: Sidley Austin (15-year lease for 75% of building)

- Size: 320,000 sq ft

- Investment: ~$380 million

- Yield: >8% unleveraged cash yield

- Construction start: 2028, delivery 2031

Total Pipeline: 8 projects, 3.5 million sq ft, $3.7 billion investment at BXP's share

Asset Sales Progress

BXP has executed $1.1 billion in dispositions (>$1 billion net proceeds), ahead of the pace outlined at September's Investor Day:

2026 Pipeline: $360 million additional sales under contract/in negotiation generating ~$230 million net proceeds

CEO Owen Thomas: "Our original goal was $1.9 billion of sales over three years from September... at this point, we're sticking with that forecast."

Balance Sheet and Liquidity

BXP maintains strong liquidity:

- Cash: $1.5 billion

- February 2026 Maturity: $1.1 billion bond redemption planned

- October 2026 Refinancing: $1 billion bond at 3.5% GAAP rate to be refinanced; current 10-year spreads of 130-140 bps imply 5.5%-5.75% new rate

Occupancy by Market

Forward Catalysts to Watch

-

Q1 Occupancy Trajectory: Management expects flat Q1 followed by sequential improvement through 2026

-

343 Madison Recapitalization: Equity partner (30-50%) and construction financing (~$1B) expected to close in 2026

-

AI Leasing Momentum: Will the 36% AI share of SF demand translate to signed leases?

-

Residential Conversion: 3,500+ units in entitlement across suburban sites, representing $200-300M of land value

-

2027 Setup: CFO noted quarterly FFO will build throughout 2026, with 2027 expirations already largely covered by signed leases

What Management Emphasized

Owen Thomas closed with a bullish tone:

"Placer.ai's office utilization data indicates December 2025 was the busiest in-office December since the pandemic and showed a 10% increase in office visits nationwide from December 2024."

"Given these positive supply and demand market trends and our strong leasing in 2025, we believe our target of 4% occupancy gain over the next two years remains achievable and more likely than when we made the forecast last September."

The Q4 2025 transcript is now available.

Related: BXP Company Profile | Q3 2025 Earnings | 10-K Annual Report